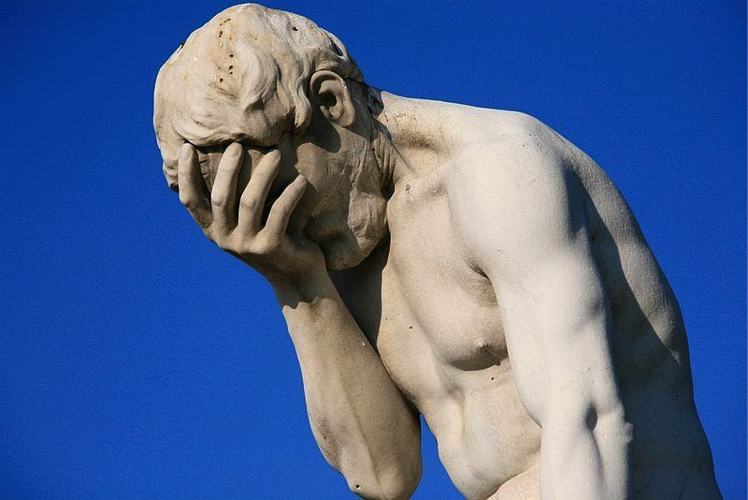

Arrrgh! How do we start a productive conversation about Inclusionary Zoning? (Part I)

I live in Portland Oregon. Moved here last December.

I live in Portland Oregon. Moved here last December.

Last year Oregon's legislature removed a prohibition on Inclusionary Zoning (IZ) which now allows cities to require a percentage of Affordable Housing units in new buildings of 20 units or more. The Portland City Council unanimously voted to put an IZ ordinance in place. Recently I have had a number of folks from around the country and from Portland ask me what I think about IZ. I have had a hard time coming up with a response that does not shut down the conversation. I get really exorcised over this topic. To be blunt, IZ makes me nuts and I tend to go off on the people who innocently ask me about it. Clearly, I need to craft a more grownup response.

I respect the motivation behind wanting to see more affordable housing get delivered. I am appalled by the naive methods being employed toward that very positive goal. I get frustrated with smart and sincere people who are serious about the delivery of housing if I think they have not made a serious effort to understand the basics of how housing gets delivered. Maybe that information has not been available to them if they are not in the business. It's not reasonable to hold people accountable for information they don't have, so let's start by laying out the basics of how a building makes money and how people decide if they want to construct a building in a given location.

If you can't get the rent, you shouldn't build the building. The rental income for a building needs to cover the Total Project Cost. This includes cost of buying the site, , paying the impact fees, designing, bidding, financing, building and leasing the building. The rental income also needs to allow for some of the units not paying rent from time to time because nobody is living in them (Vacancy). Finally, the rental income needs to be able to cover the building's Operating Expenses which include property taxes, insurance, property management, maintenance, water, sewer and trash, and replacements reserves of $300-$500 per unit set aside each year.

In addition to covering these costs, a building need to make a profit to justify why someone is going to put up 20% - 40% of the cash need to make the building happen. Whoever puts that money up (and signs a guaranty to repay the construction loan that will provide the rest) has other things they can do with that money and they can reasonably expect to get paid something for the risk they are taking in undertaking a construction project. A construction project has more risk than a savings account, treasury bond or mutual fund, so money put into a real estate project has to pay a higher return than alternative investments with lower risk. A workable rule of thumb is that $1 in monthly rent can typically support $100 in Total Project Costs and yield a reasonable return of 10-12% on the cash you put in the building.

What happens if 20% of the units in a building don't pay their way because the rent you can charge has been limited by the IZ Ordinance? The assumption is that you will have to convince the potential tenants for the other 80% of the market rate units to pay higher rent, or find a way to reduce the Total Project Cost. Reducing Total Project Costs will come down to convincing the person selling you the site that you need to pay less for it.

In Part II we can walk through the math on how this works on a example building.