How Do I Get Started as a Developer? --With a Four-Plex.

Updated june 2, 2016

NOTE: The Limit on Nonresidential space in a 1-4 unit home financed with a FHA 203(b) mortgage was increase from 25% to 49% in September of 2015.

A question that I am hearing a lot from prospective developer/builders is "How do I get started?". One way to get started is with a Four Plex that you will also live in.

Over the last 10 months I have been digging into the details of the FHA four plex loan program and the FHA 203K Rehab and mortgage program which is available for 1-4 units as vehicles to help people get started. I will be presenting this Dallas this week at CNU 23 in the session with Monte Anderson at 9am on Thursday morning

How to Build & Finance Small-Scale Incremental Urbanism,

but here is the short version:

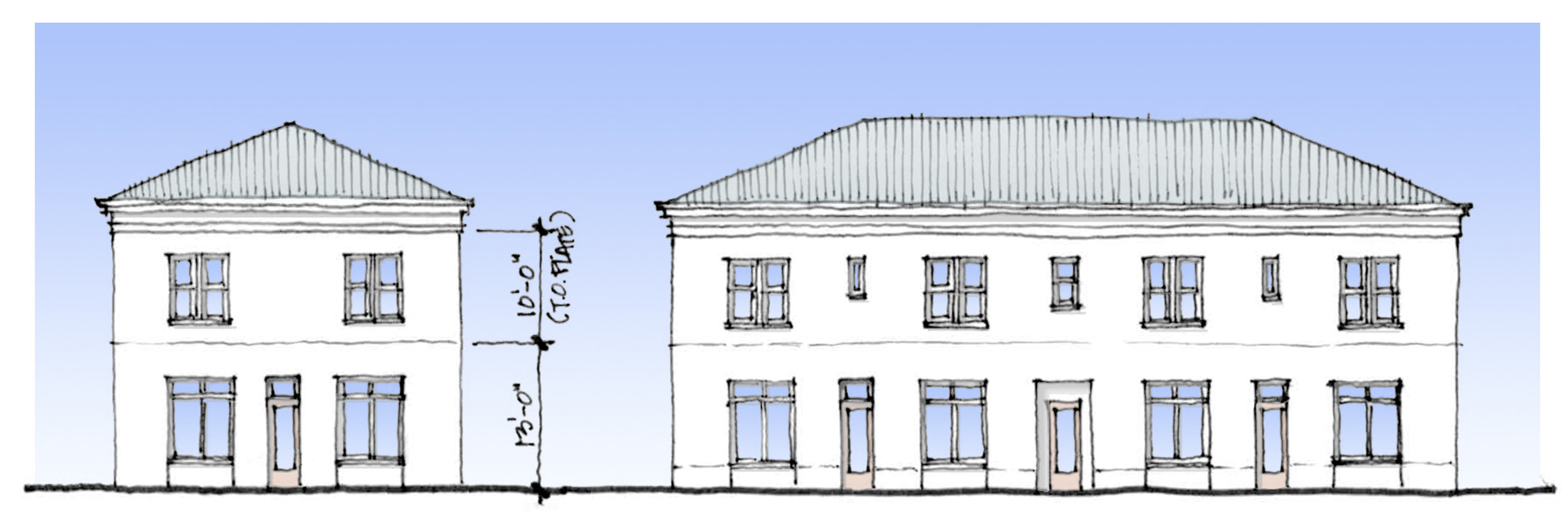

Goal = A rookie developer builds a 4 plex with a partner and buys it with an FHA 30 year mortgage. They establish a modest but credible track record while working on a lean project at low risk.

Project costs for the sake of this exercise = $600,000.

- Conventional 75% Loan To Cost (LTC) construction loan guaranteed by an investor who puts up $150,000 in equity (and has second position on the land and building after the bank's typical lien position).

- The rookie developer runs the project and earns a fee,( included in the $600K project cost) to support themselves for 8-12 months while the project is under construction.

The Investor has a contract to sell the Four Plex to the rookie developer for $650,000 and the rookie developer has pre-qualified for an FHA insured 30 year mortgage (FHA 203-b) with the following underwriting requirements:

- Borrower has 2 years of employment with stable or rising income.

- 3.5% down payment (which can be gifted funds).

- Reserves of 3 months PITI.

- Credit Score minimum 580 (640 is more the real world score for local bank underwriting with the FHA insurance).

- PITI cannot exceed 30% of borrower's gross income which includes 75% of the gross rent on the other three residential units.

- One of the four-plex units must be occupied by the borrower as their primary residence for at least 12 months.

- A maximum of 49% of the building floor area can be non-residential use. Appraiser will verify the non-residential use complies with local zoning.

Assuming a year for construction and lease up, the Investor/Guarantor would see a 35% IRR on an investment in a hard asset with minimal construction and leasing risk. The 30 year FHA mortgage as the take out loan is really straight forward. The rookie developer and the investor get to know each other in a low risk deal that takes 8-12 months.

The developer goes through the entire project arc and end up owning a building with some decent equity which they helped create. The developer has demonstrated their ability to get a project financed, built and occupied. They can live cheap while pursuing their next project (rent free) in a live/work that showcases what they can do. PDF of the FHA Underwriting Manual:

The FHA 203K approach could be similar for an existing building. You can use the FHA 203-k purchase/rehab loan to purchase an existing small apartment building of 5-6 small units that could be converted to a 4 plex as part of the renovation. FHA 203-k loans are set up to include the cost of renovations. Small apartment buildings are tough to finance with conventional commercial loans and tend to get rented to death, requiring a lot of work when they go up for sale. Unfortunately the 203-k loan can take 6-8 months to get approved.

The intent with both of these approaches is a low risk entry into development and building with the rookie developer fully engaged and gaining experience in all aspects of a project in a compressed arc.