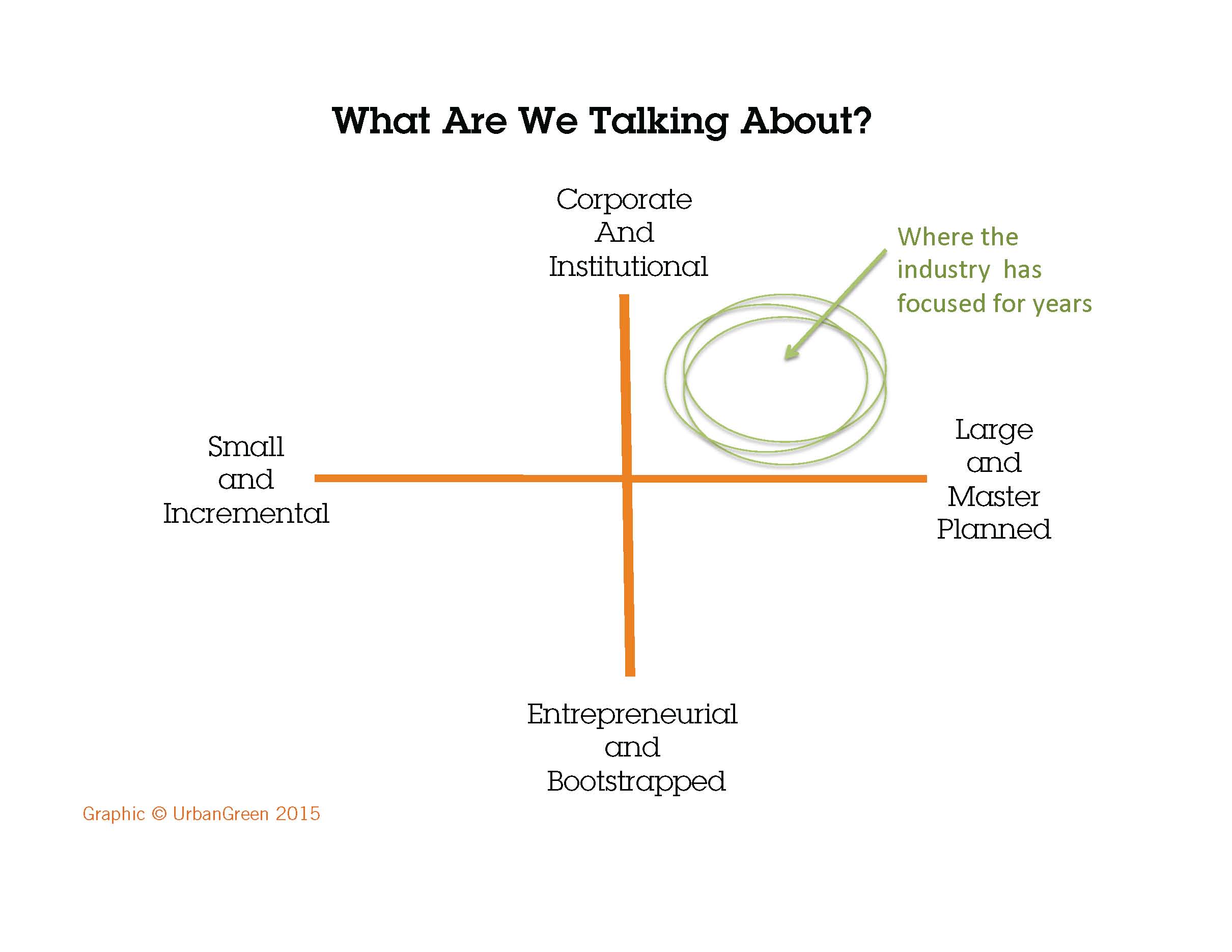

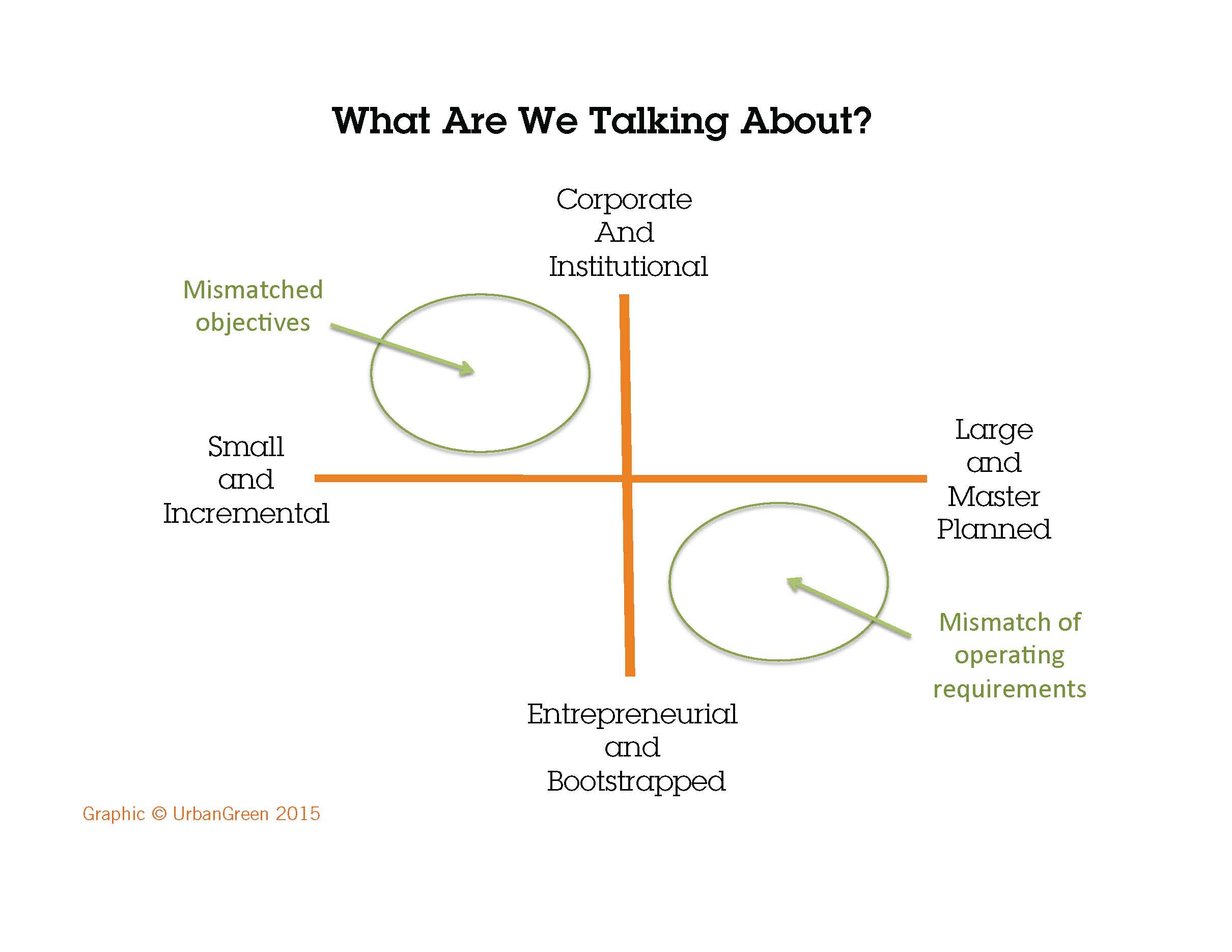

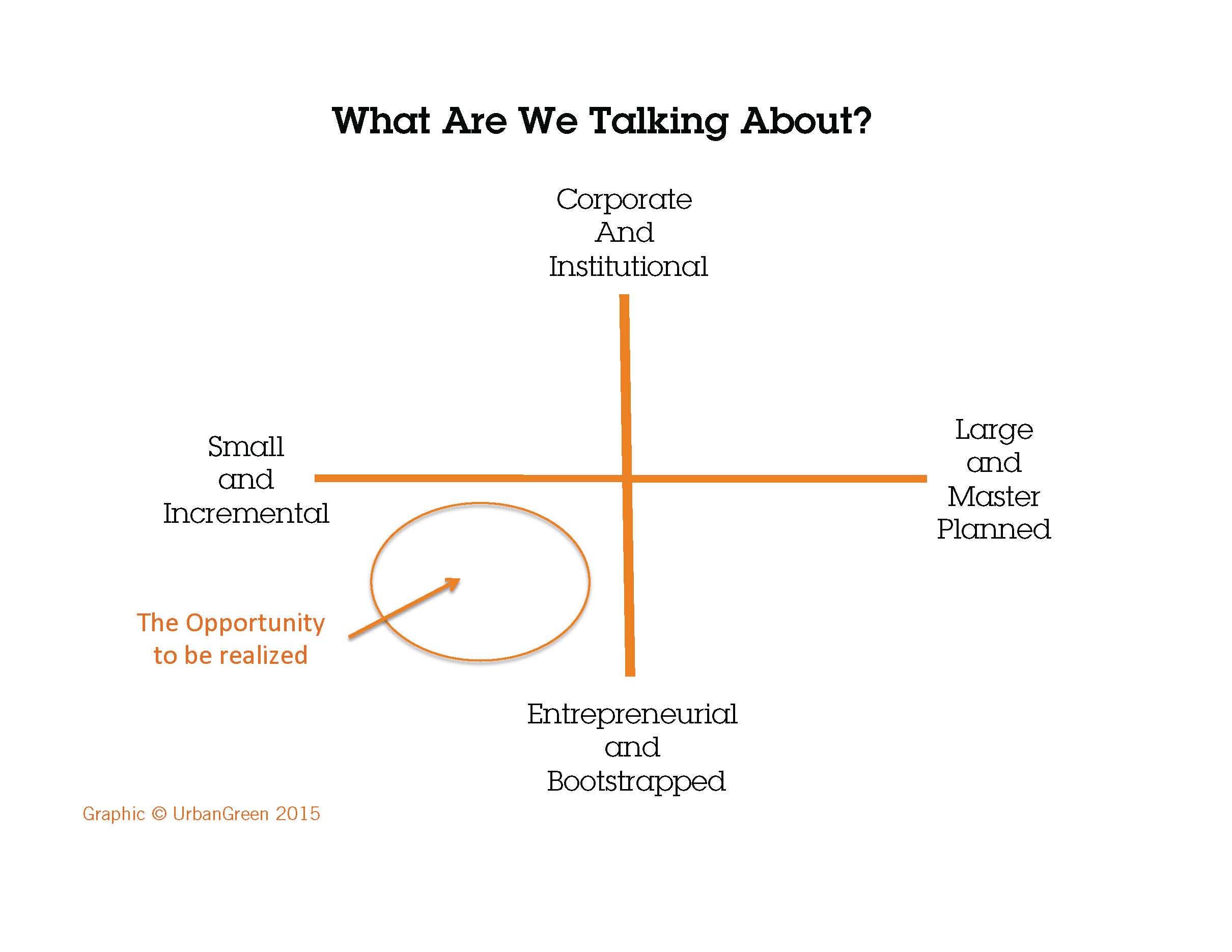

If a picture is worth a thousand words, then the right diagram is worth at least ten thousand. I am very grateful Jim Heid of Urban Green has boiled down the difference between Large and Master Planned Development and Small and Incremental Development into the series of excellent diagrams above.

I recently had a conversation with a bright guy in a Masters in Real Estate Development program at a serious university. He was wondering if a Real Estate Investment Trust (REIT) would be a good vehicle for people in a local community to be able to invest in small projects in their neighborhood. Just to set things straight, a REIT would not be a good vehicle for this as a REIT has to have a lot of property under management to justify their existence and overhead, so the structure would be way beyond the scale of small projects in a specific neighborhood. Investors would own shares in an outfit that owns a large portfolio of a specific type of real estate.

-But the conversation reminded me of Jim Heid's diagram. The kind of local in the neighborhood projects my grad student friend was describing belong in the lower left quadrant of Jim's diagram, the Small and Incremental/Entrepreneurial and Bootstrapped territory. Ownership of real estate by a REIT belongs up in the Corporate and Institutional/Large and Master Planned upper right quadrant. We might want to bring established tried and true tools scaled for the upper right quadrant to bear on projects in the lower left, but often the scale is just...off. I think we can call that a Quadrant Foul.

Rethinking the development business model for Small Developers will continues to uncover habits that may serve folks doing large project well that need to be substantially retooled to work in small projects, or they may just need to be set aside as because they are not fit to the purpose.